We have penned the detailed notes of class 10th NCERT chapter Money and credit to help the board appearing candidates with the crux of the lesson Money And Credit Class 10th NCERT along with the mind map of Money And Credit Class 10th NCERT to help the students of class 10th with the lesson and make them crystal clear.

Money And Credit Class 10th: Introduction

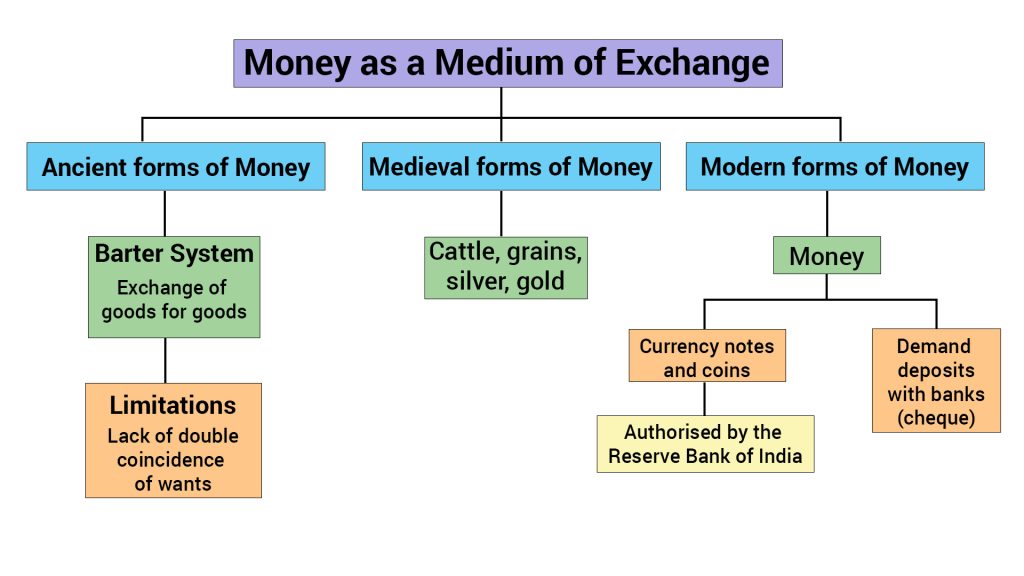

MONEY AS A MEDIUM OF EXCHANGE

1. A person holding money can exchange it for any commodity or service that he or she

might want.

2. Thus everyone prefers to receive payments in money and then exchange the money for

things that they want.

3. Both parties must agree to sell and buy each other commodities. This is known as a

Double coincidence of wants.

4. What a person desires to sell is exactly what the other wishes to buy.

5. In a barter system where goods are directly exchanged without money, the

double coincidence of wants is an essential feature.

6. In contrast, in an economy where money is in use, money by providing the crucial

intermediate step, eliminates the need for double coincidence of wants.

7. Money is an intermediate in the exchange process; it is called a medium of exchange. This is known as Barter System.

MODERN FORMS OF MONEY

1. We have seen that money can act as a medium of exchange in

transactions.

2. Before the introduction of coins, various objects were used as money.

3. Indians used grains and cattle from very early ages as money.

Currency

1. Modern forms of money include currency – paper notes and coins.

2. Money is accepted as a medium of exchange because the currency is authorized by the

country’s government.

3. In India, the Reserve Bank of India issues currency notes on behalf of the central

government.

4. As per Indian law, no other individual or organization is allowed to issue currency.

Deposits with Bank

1. The other form in which people hold money is as deposits with the bank.

2. People deposit money with the banks by opening a bank account in their name.

3. Banks accept the deposits and also pay an amount as interest on the deposits.

4. People also have the provision to withdraw money as and when they require it.

5. Since the deposits in the accounts can be withdrawn on demand, these deposits are called demand deposits.

6. This facility lends it the essential characteristics of money.

7. You would have heard of payments being made by cheques instead of cash.

8. For payment by cheque, the buyer who has an account with the bank makes out a cheque for a specific amount.

9. A cheque is a paper instructing the bank to pay a specific amount from the person’s

account to the person whose name the cheque has been issued.

10. The facility of cheques against demand deposits makes it possible to settle payments without using cash directly.

11. Since demand deposits are accepted widely as payment and currency,

they constitute money in the modern economy.

12. But for the banks, there would be no demand and no payments by cheques against these deposits. The modern forms of money – currency and deposits – are closely linked to the working of the modern banking system.

LOAN ACTIVITIES OF BANKS

1. Banks keep only a tiny proportion of their deposits as cash.

2. This is kept as a provision to pay the depositors who might come to withdraw money from the bank on any given day.

3. Since, on any particular day, only some of its many depositors come to withdraw cash, the bank can manage with this cash.

4. Banks use the central portion of the deposits to extend loans.

5. There is a huge demand for loans for various economic activities.

6. Banks use deposits to meet the loan requirements of the people.

7. In this way, banks mediate between those who have surplus funds and those who need these funds.

8. Banks charge a higher interest rate on loans than they offer on deposits.

9. The difference between what is charged from borrowers and what is paid to depositors is their primary source of income.

TERMS OF CREDIT

1. Every loan agreement specifies an interest rate that the borrower must pay to the lender along with the repayment of the principal addition; lenders may demand collateral against the loan.

2. Collateral is an asset that the borrower owns and uses as a guarantee to a lender until the loan is repaid.

3. The interest rate, collateral and documentation requirement, and the mode of repayment comprise the terms of credit.

Money And Credit Class 10th: Formal Sector Credit In India

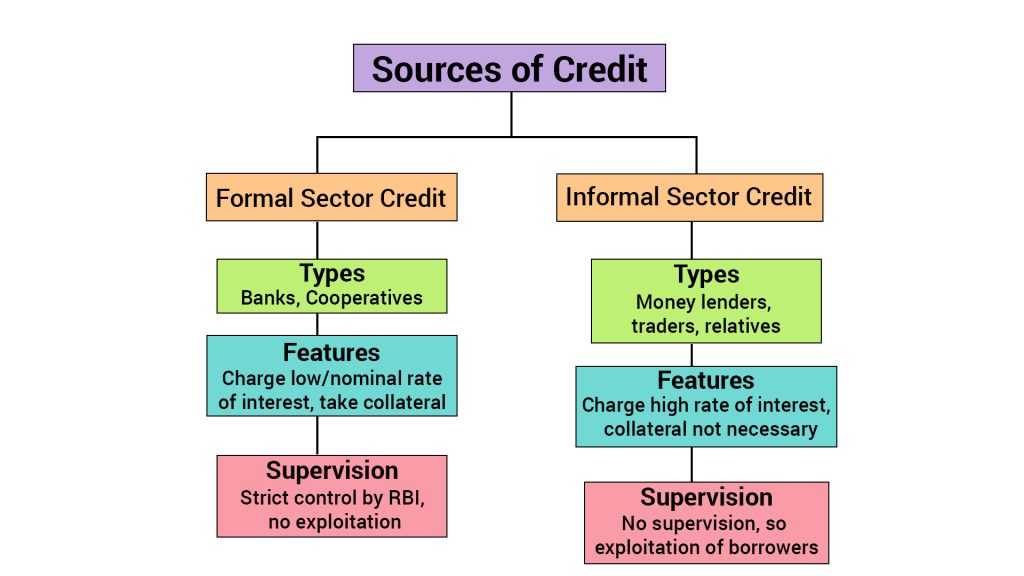

1. We have seen that people obtain loans from various sources.

2. The various types of loans can be conveniently grouped as formal and informal

sector loans.

3. Among the former are loans from banks and cooperatives.

4. The informal lenders include moneylenders, traders, employers, relatives, friends, etc.

5. The Reserve Bank of India supervises the functioning of formal sources of loans.

6. For instance, we have seen that banks maintain a minimum cash balance out of the

deposits they receive.

7. The RBI monitors the banks in actually maintaining a cash balance.

8. Periodically, banks must submit information to the RBI on how much they are lending,

to whom, at what interest rate, etc.

9. no organization supervises the credit activities of lenders in the informal

sector.

10. They can lend at whatever interest rate they choose.

11. There is no one to stop them from using unfair means to get their money back.

12. Compared to formal lenders, most informal lenders charge much higher

interest on loans.

13. Thus, the cost to the borrower of informal loans is much higher.

14. The Higher cost of borrowing means a large part of the borrowers’ earnings is used

to repay the loans.

15. Cheap and affordable credit is crucial for the country’s development.

Formal and Informal Credit: Who gets what?

1. 85% of the loans taken by poor households in urban areas are from informal sources.

2. Urban households take only 10% of their loans from informal sources, while 90% are

from formal sources.

3. The affluent households are availing of cheap credit from informal lenders, whereas the poor

households have to pay a large amount of borrowing.

4. The formal sector still meets only about half of the total credit needs of the rural people.

5. The remaining credit needs are met from informal sources.

6. Thus, banks and cooperatives must increase their lending, particularly in the

rural areas so that the dependence on informal sources of credit reduces.

7. While formal sector loans need to expand, it is also necessary that everyone receives these

loans.

8. The formal credit must be distributed more equally so that the poor can

benefit from the cheaper loans.

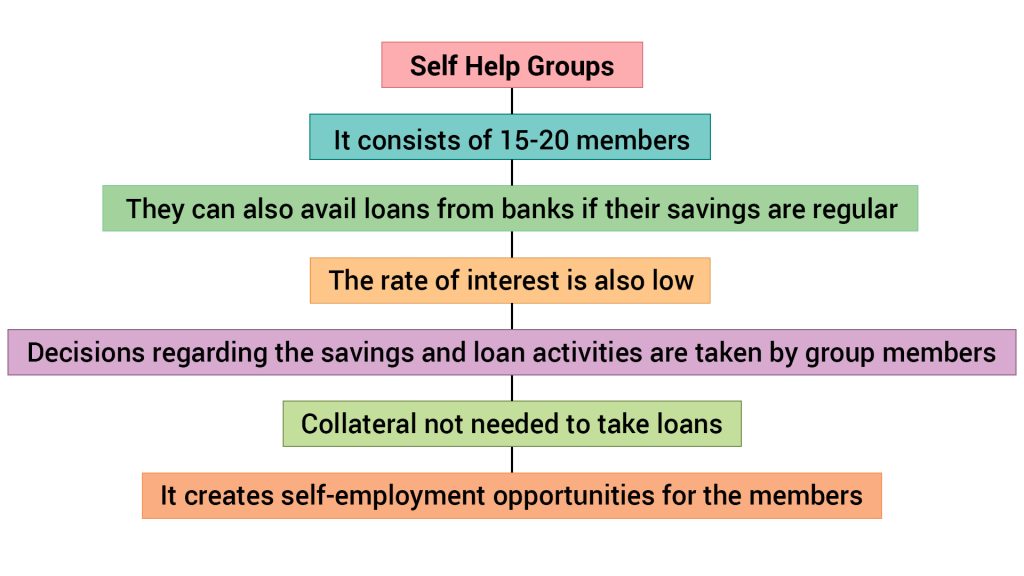

SELF-HELP GROUPS FOR THE POOR

1. In the previous section, we have seen that poor households still depend on informal credit sources.

2. Banks are not present everywhere in rural India.

3. Even when they are present, getting a loan from a bank is much more complex than taking a loan from informal sources.

4. The absence of collateral is a significant resource that prevents the poor from getting bank loans.

5. Informal lenders such as moneylenders, on the other hand. Known the borrowers

personally and are often willing to give a loan without collateral.

6. However, the moneylenders charge very high-interest rates, keep no records of the

transactions and harass the poor borrower.

7. People have recently tried out newer ways of providing loans to the poor.

Money And Credit Class 10th NCERT: Mind Map

We have shared the mind map to make learning easy for the students of Class 10TH. We know that board-appearing candidates have a lot to study, and under so much pressure from many subjects, mind maps are an easy way to remember the concepts.

We are sharing the mind maps of Money And Credit Class 10th to make the chapter and the conceptual knowledge pristine.

Money And Credit Class 10th: NCERT Solutions

Q1. In situations with high risks, credit might create further problems for the borrower. Explain?

- High-risk situations occur in rural areas because there the main demand for credit is for crop production which involves considerable costs on seeds, fertilizers, pesticides, water, electricity, and repair of equipment.

- There is a minimum stretch of three to four months between the time when farmers buy these inputs and when they sell the crop.

- Farmers generally take crop loans at the beginning of the season and repay the loan after harvest.

- Repayment of the loan is crucially dependent on the income from farming.

- If a crop fails due to a shortage of rain or for any other reason, a small farmer has to sell a part of the land to repay the loan.

- Failure of crops creates further problems for the borrowers. Credit does not improve his earnings but leaves him worse off than before. Credit in high risks situations pushes the borrower into a debt trap, a situation from which recovery is very painful.

Q2. How does money solve the problem of double coincidence of wants? Explain with an example of your own.

In a barter system where goods are directly exchanged without the use of money, double coincidence of wants is an essential feature. By serving as a medium of exchange, money removes the need for double coincidence of wants and the difficulties associated with the barter system. For example, it is no longer necessary for the farmer to look for a book publisher who will buy his cereals and at the same time sell him books. All he has to do is find a buyer for his cereals. If he has exchanged his cereals for money, he can purchase any goods or services which he needs. This is because money acts as a medium of exchange.

Q3. How do banks mediate between those who have surplus money and those who need money?

1. Banks keep only a tiny proportion of their deposits as cash.

2. This is kept as a provision to pay the depositors who might come to withdraw money from the bank on any given day.

3. Since, on any particular day, only some of its many depositors come to withdraw cash, the bank can manage with this cash.

4. Banks use the central portion of the deposits to extend loans.

5. There is a huge demand for loans for various economic activities.

6. Banks use deposits to meet the loan requirements of the people.

7. In this way, banks mediate between those who have surplus funds and those who need these funds.

8. Banks charge a higher interest rate on loans than they offer on deposits.

9. The difference between what is charged from borrowers and what is paid to depositors is their primary source of income.

Q4. What is the basic idea behind the SHGs for the poor? Explain in your own words.

1. In the previous section, we have seen that poor households still depend on informal credit sources.

2. Banks are not present everywhere in rural India.

3. Even when they are present, getting a loan from a bank is much more complex than taking a loan from informal sources.

4. The absence of collateral is a significant resource that prevents the poor from getting bank loans.

5. Informal lenders such as moneylenders, on the other hand. Known the borrowers

personally and are often willing to give a loan without collateral.

6. However, the moneylenders charge very high-interest rates, keep no records of the

transactions and harass the poor borrower.

7. People have recently tried out newer ways of providing loans to the poor.

Q5. Fill in the blanks:

- The majority of the credit needs of the __________households are met from informal sources.

- __________costs of borrowing increase the debt-burden.

- __________issues currency notes on behalf of the Central Government.

- Banks charge a higher interest rate on loans than what they offer on __________.

- _________is an asset that the borrower owns and uses as a guarantee until the loan is repaid to the lender.

Q6. Choose the most appropriate answer.

(i) In an SHG most of the decisions regarding savings and loan activities are taken by

(a) Bank.

(b) Members.

(c) Non-government organization.

(ii) Formal sources of credit do not include

(a) Banks.

(b) Cooperatives.

(c) Employers.

Answer:

(i) (b)

(ii) (c)

Money And Credit Class 10th: MCQs

We have shared Money And Credit Class 10th MCQs to help the students to get an understanding of the lesson Money And Credit Class 10th. Solving MCQs will help you to get the gist of the lesson and make your concepts crystal clear.

Question 1.

Farmers usually take crop loans at the beginning of the season and repay the loan after:

(a) Sowing

(b) Tilling

(c) Harvesting

(d) All the above

Answer

Answer: (c) Harvesting

After harvesting.

Question 2.

Credit sometimes pushes the borrower to a situation from which recovery is:

(а) Easy

(b) Hard

(c) Very painful

(d) None of the above

Answer

Answer: (c) Very painful

To a condition that is very painful.

Question 3.

Sometimes lenders demand against loan:

(a) Payment

(b) Cheque

(c) Draft

(d) Collateral

Answer

Answer: (d) Collateral

Collateral is the security that lenders demand against loans.

Question 4.

Interest rate, security and documentation requirement, and the mode of repayment together

comprise what is called the:

(a) Loan factor

(b) Credit factor

(c) Terms of the loan

(d) Terms of credit

Answer

Answer: (d) Terms of credit

All are terms of credit.

Question 5.

Loans from banks and cooperatives are called:

(a) Mixed loans

(b) Term loans

(c) Formal loans

(d) Informal loan

Answer

Answer: (c) Formal loans

They are called formal loans.

Question 6.

Loans from moneylenders, traders, employers, relatives, and friends are called:

(а) Mixed loans

(b) Term loans

(c) Formal loans

(d) Informal loans

Answer

Answer: (d) Informal loans

They are called informal loans.

Question 7.

The RBI monitors the banks are actually maintaining:

(а) Cash books

(b) Cash balance

(c) Cash register

(d) None of the above

Answer

Answer: (b) Cash balance

The RBI monitors the banks are actually maintaining cash balance.

Question 8.

Most of the informal lender’s charge:

(a) A less interest on loans

(b) A much higher interest on loans

(c) Can be both (a) and (b)

(d) None of the above

Answer

Answer: (b) A much higher interest on loans

Most of the informal lenders charge much higher interest on loans.

Question 9.

The rich households are availing of cheap credit from formal lenders whereas the poor households:

(a) Do not get a loan

(b) Get a loan at a much less interest

(c) Have to pay a heavy price for borrowing

(d) None of the above

Answer

Answer: (c) Have to pay a heavy price for borrowing

The poor households do not have papers and thus, have to pay a heavy price for borrowing.

Question 10.

Cheap and affordable credit is crucial for:

(а) The development of urban areas

(b) The development of rural areas

(c) The country’s development

(d) All the above

Answer

Answer: (c) The country’s development

For the country’s development.

Question 11.

About 85 percent of the loans taken by poor households in the urban areas are from:

(a) Formal sources

(b) Informal sources

(c) Mixed sources

(d) None of the above

Answer

Answer: (b) Informal sources

Are from informal sources, because they do not have the required documents.

Question 12.

Most loans from informal lenders carry a very high-interest rate and do little to:

(a) Do anything for the poor

(b) Pay the loans

(c) Increase the income of the borrowers

(d) None of the above

Answer

Answer: (c) Increase the income of the borrowers

Loans from informal lenders do little to increase the income of the borrowers because their rates

are high.

Question 13.

It is important that the formal credit is distributed more equally so that:

(a) The rich can benefit from the cheaper loans

(b) The poor can benefit from the cheaper loans

(c) The women can benefit from the cheaper loans

(d) None of the above

Answer

Answer: (b) The poor can benefit from the cheaper loans

So that the poor people can benefit from the cheaper loans.

Question 14.

The full form of SHG is:

(а) Station House Guard

(b) State Housing Guarantee

(c) Self-Happy Groups

(d) Self-Help Groups

Answer

Answer: (d) Self-Help Groups

It is Self Help Groups.

Question 15.

The SHGs help borrowers overcome the problem of:

(а) Lack of funds

(b) Lack of money

(c) Lack of collateral

(d) None of the above

Answer

Answer: (c) Lack of collateral

The SHGs help borrowers overcome the problem of lack of collateral.

Question 16.

Everyone prefers to receive payments in:

(a) Goods

(b) Cheque

(c) Draft

(d) Money

Answer

Answer: (d) Money

Money can buy anything and thus, everyone prefers to receive payments in money.

Question 17.

When both parties agree to sell and buy each other’s commodities it is known as:

(a) Single coincidence of wants

(b) Double coincidence of wants

(c) Coincidence of wants

(d) None of the above

Answer

Answer: (b) Double coincidence of wants

It is called a double coincidence of wants.

Question 18.

Money is something that can act as a medium:

(a) For exchange of commodities.

(b) For exchange of goods

(c) Of exchange in transactions

(d) None of the above

Answer

Answer: (c) Of exchange in

transactions

Money acts as a medium of exchange in transactions.

Question 19.

An early ages, Indians used grains and cattle as:

(a) Money

(b) Food

(c) Public property

(d) None of the above

Answer

Answer: (a) Money

Grains and cattle were used as money.

Question 20.

Modern forms of currency include:

(a) Grains and cattle

(b) Coins and paper notes

(c) Cheques and passbook

(d) None of the above

Answer

Answer: (b) Coins and paper notes

It includes coins and paper notes.

Question 21.

Which of the following banks issues currency notes on behalf of the Central government:

(a) State Bank of India

(b) Commercial Bank of India

(c) Industrial Bank of India

(d) Reserve Bank of India

Answer

Answer: (d) Reserve Bank of India

The RBI issues currency.

Question 22.

No individual in India can:

(a) Legally refuse a payment made in rupees

(b) Legally refuse a payment made by cheque

(c) Legally refuse a payment made by draft

(d) All the above

Answer

Answer: (a) Legally refuse a payment made in rupees

No individual in India can legally refuse a payment made in rupees.

Question 23.

Banks accept the deposits of the customers and also:

(a) Give a gold coin in return

(b) Give a silver coin in return

(c) Give a chequebook

(d) Pay an interest rate on the deposits

Answer

Answer: (d) Pay an interest rate on

the deposits

Banks also pay an interest rate on deposits.

Question 24.

Since the deposits in the bank accounts can be withdrawn on demand, these deposits are called:

(a) Smart deposit

(b) Quick deposits

(c) Demand deposits

(d) All the above

Answer

Answer: (c) Demand deposits

The deposits are called demand deposits.

Question 25.

A paper, instructing the bank to pay a specific amount to the person in whose name the paper has

been made is called a:

(а) Cheque

(b) Draft

(c) Payment slip

(d) None of the above

Answer

Answer: (а) Cheque

It is called a cheque.

Question 26.

Banks use the major portion of the deposits:

(a) For constructing

(b) As fixed deposits

(c) To extend loans

(d) None of the above

Answer

Answer: (c) To extend loans

Banks use the major portion of the deposits to extend loans.

Question 27.

Banks mediate between those who have surplus funds and those:

(а) Who have fixed deposits

(b) Who have gold ornaments

(c) Who are in need of these fluids

(d) None of the above

Answer

Answer: (c) Who are in need of these fluids

Those who are in need of funds.

Question 28.

The difference between what is charged from borrowers and what is paid to depositors is:

(a) The rate of interest

(b) Never Equal

(c) The main source of income of banks

(d) None of the above

Answer

Answer: (c) The main source of income for banks

It is the main source of income for banks.

Question 29.

An agreement in which the lender supplies the borrower with money, goods or services in return

for the promise of future payment is called:

(a) Loans

(b) Debt

(c) Credit

(d) All the above

Answer

Answer: (c) Credit

It is called credit.

Question 30.

In rural areas, the main demand for credit is for:

(a) House loan

(b) Education

(c) Crop production

(d) All the above

Answer

Answer: (c) Crop production

It is for crop production.

Conclusion

We have shared detailed notes of Class 10th NCERT chapter Money and credit to help you all with the crux of the lesson Money And Credit Class 10th NCERT along with the mind map of Money And Credit Class 10th NCERT to help the students of class 10th with the lesson and make them crystal clear. We have also penned down Money And Credit Class 10th MCQs to help in every possible manner to get a complete understanding of the lesson.

Related Articles

- Class 12 English Core Sample Paper 2023

- CBSE Class 12 Economics Sample Paper 2023

- CBSE Class 12 Business Studies Sample Paper 2023

- Tenses Class 9th English Grammar CBSE

- Subject Verb Agreement Class 9th English CBSE

- NCERT Solutions For Class 10 Civics Social Science Chapter 1: Power-sharing

- Lifelines Of National Economy Class 10th NCERT

- Minerals And Energy Resources Class 10th NCERT